When Private Equity Meets Brand Equity

April 3, 2019

Or what happens when what can’t be measured doesn’t get managed OR what can’t be measured isn’t accounted for?

“Tomayo!” cried my wife. “That’s what they should have called it. Not “Mayochup”.

My wife is a speech and language pathologist, so in our house all questions regarding the use of language are subject to her expertise. We were discussing Kraft-Heinz’s latest entries into the condiments aisle, or more accurately, Toronto Star journalist Jennifer Wells’ recent article about the challenges faced by the beleaguered processed food giant.

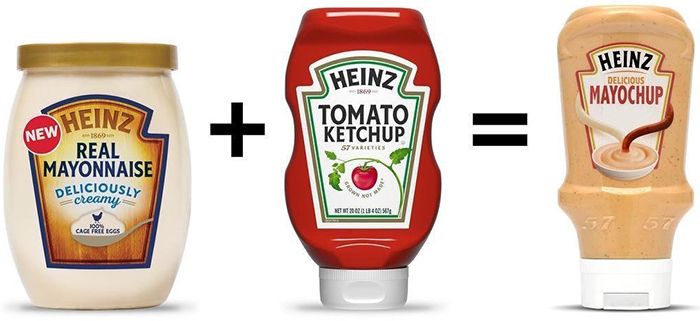

The question Wells ponders in her piece is whether or not the introduction of Mayochup (mayonnaise and ketchup), Mayocue (mayonnaise and barbecue sauce) and Mayomust (mayonnaise and mustard) will alleviate the fiscal pain at K-H currently suffering through the indignities of a $15.4 billion impairment charge and an almost 50% drop in share value since 2015.

The irony is that if you look at the ‘about’ page of 3G capital’s website, the first sentence reads: “3G Capital is a global investment firm focused on long-term value, with a particular emphasis on maximizing the potential of brands and businesses” (italics mine). It’s a classic case of cognitive dissonance – and corporate bullshit. In this case ‘maximising potential’ really means minimizing costs and hoping that the equity of the newly purchased brand will absorb the impact of ruthless financial parsimony. That’s like starving a child and expecting it to become a star athlete. It exposes a profound lack of understanding of how brands work, how fragile they can be and how critically important intangible assets are.

A perfect example of this was last year’ Tim Hortons franchisee fiasco. Cost pressure from its owner Restaurant Brands International (a consolidating cost-cutter like 3G) collided with the Ontario government’s minimum wage hike, inspiring some franchisees to cut back on employee benefits, hours and wages. The impact on both employees and customers was immediate and dramatic: a leading brand survey by Leger Marketing, National Public Relations and the Globe and Mail conducted a year ago saw Timmy’s drop from #4 to #50 on the list of Canada’s most admired companies. Another one by Ipsos saw it drop from 9th to 16th on a list of Canada’s most influential brands.

As an interviewee told Jennifer Wells, private equity firms only look at the numbers. They are incapable of assessing any kind of off-balance-sheet intangible value, which as recent manoeuvres at Kraft-Heinz and Tim Hortons have shown is risky business.

It’s a bitter example of what happens when what can’t be measured doesn’t get managed. wn